New Home Market Update

An outstanding question about the housing market is how demand might progress over the next 18 months given elevated inflation and higher mortgage rates. Officials at the Federal Reserve are committed to stabilizing the economy, and the most recent rate increase of 0.75% adds to the uncertainty regarding overall market conditions. In addition, the Fed has been moving since mid-2022 to reduce the size of its balance sheet (known as quantitative tightening), which will further restrict credit activity. With housing being one of the most interest rate-sensitive industries, there is great curiosity about how these changes will affect the homebuilding sector.

The 30-year fixed rate mortgage has risen in response to policy changes and inflation, moving from an average of just over 3% at the beginning of this year to nearly 7% in early October. Zonda data shows that higher mortgage rates combined with faltering consumer confidence have already significantly cooled the housing market. Zonda’s New Home Pending Sales Index is 25.1% below the levels seen last year.

Prospective buyers and sellers are wondering what may come next. The issue becomes that, given the unprecedented nature of the pandemic shock followed by trillions of dollars in fiscal and monetary stimulus to support the economy, there is not a good historical analog to the current situation. The stimulus to the economy in 2020 and 2021 proved effective in averting a prolonged recession or even a feared depression, but the economy is now largely considered overheated.

Given inflation and the idea that the economy is running too hot, the Federal Reserve has committed to continued increases in the federal funds rate (FFR). Chair Powell, during the press conference on September 21, 2022, said: “We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to two percent.” Further, Chair Powell added, “restoring price stability will likely require maintaining a restrictive policy stance for some time.”

With this guidance in mind, the chance of a recession in 2023 has become elevated. Zonda’s forecasts are modeled assuming a ‘run of the mill’ recession, though there are risks related to potential severity. What we know, though, is that Chair Powell and the Fed are looking back at history to see what kind of policy response might make sense given the elevated levels of inflation currently in the economy.

A historically high inflation period was in the 1970s and early 1980s with the consumer price index (CPI) inflation averaging 7.1% across the period from January 1970 to January 1980. During this time, the US economy was stuck in a high inflation pattern, partially made worse by the Fed’s “stop-go” policy of raising rates and quickly reversing with rate cuts. The high inflation era is generally recognized as being ended by Chair Volcker’s policy where the FFR maxed out at 19.1% in June 1981, which caused a substantial recession. Ultimately, inflation did come down to acceptable levels following the high-rate era.

While we believe today’s inflationary environment is different than the 1970s and 1980s, Chair Powell and the Board of Governors likely have this historical episode in the back of their minds as they plan the future path of the FFR. Powell is quoted saying, “the historical record cautions strongly against prematurely loosening policy.”

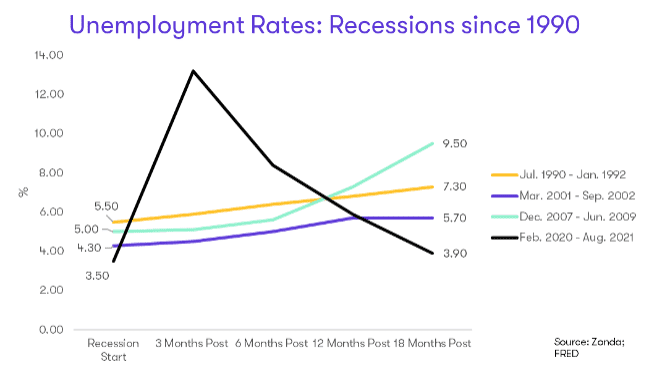

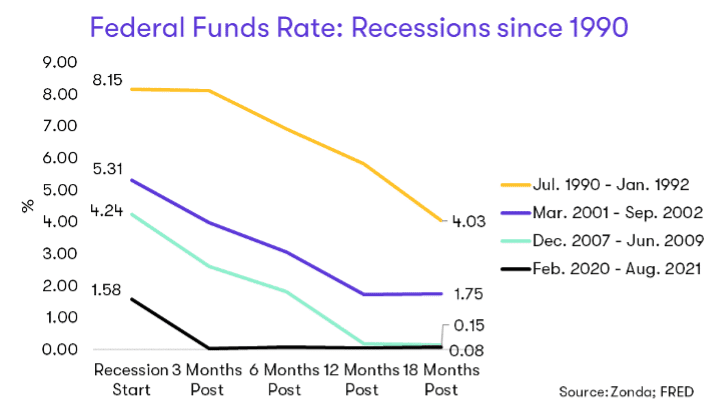

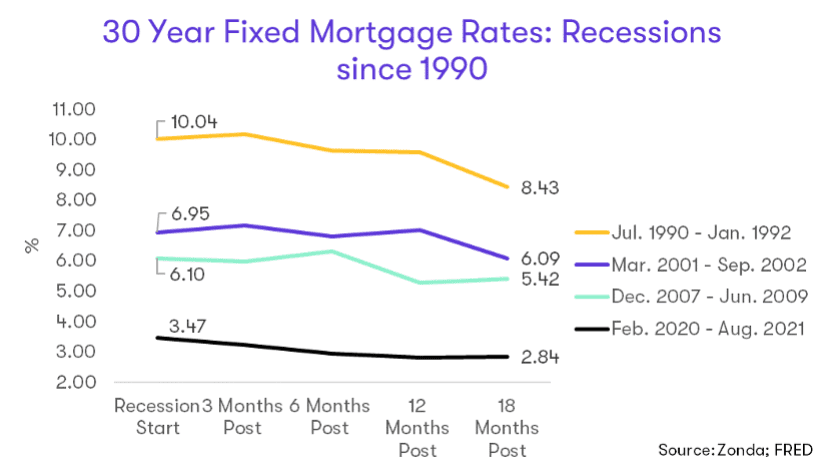

If a recession does occur in the near term, it is important to prepare for how things may evolve over the next 18 months. To do this, we look back to the four recessions over the past 30 years for guidance on how unemployment levels, the FFR, and the 30-year fixed-rate mortgage might trend, knowing every recession is different. The historical trends can help us predict what could happen to the housing market in 2023.

Note, all the graphs featured in this article show the progression of the various rates from the start of the specific recession through 18 months after the beginning of the recession.

The unemployment rate rises in response to slower growth

The unemployment rate typically rises 1.6 percentage points by six months after the official start of a recession and about 2 percentage points 18 months post the start of a recession. As employment and housing typically move together, the labor market is critical to watch as strength or weakness in employment growth has a strong impact on housing demand.

The Fed historically reverses course quickly

With higher unemployment and lower levels of consumer demand, the Federal Reserve typically begins cutting the FFR three to six months post-peak levels. Looking beyond the 1990s, however, we know that inflationary times have historically called for more firm policies. The Fed may be hesitant to cut too quickly this time to avoid the previous mistakes seen in the 1970s and 1980s high inflation era.

Mortgage rates take more time to adjust

Mortgage rates do come down following a recession, but the 30-year fixed rate mortgage has historically been stickier than the FFR with an average decline of about 100 basis points after 18 months considering recessionary periods since 1990.

Today’s historic affordability shock combined with economic uncertainty has pushed some buyers temporarily to the sidelines. A more substantial economic recession would be another hurdle for many potential buyers as significant job losses or real wage declines would further the challenges. While in the near term we expect continued volatility in the housing market, further out we anticipate some of the headwinds to dissipate as the economic situation stabilizes and buyers are eventually enticed back into the market.

Learn more

Zonda Advisory services cover the entire spectrum of real estate, helping companies grow their business and realize their goals. Our work is tailored to each client to help them lead, expand and evolve. Contact us today to learn more about our expansive Advisory services by clicking the button below.

About Ali

Ali Wolf is the Chief Economist for Zonda, the largest new home construction data company in North America. As head of the Economics Department, Ali manages and analyzes the content for Zonda, runs special research projects, strategizes with the nation’s largest homebuilders, and presents nationwide covering topics across the housing market and wider economy.