New Home Market Update

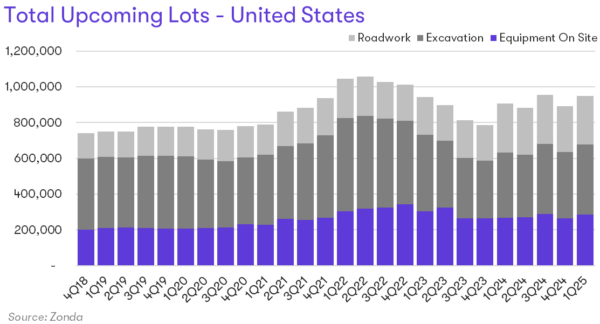

Total upcoming lots for 1Q25 increased 4.7% year-over-year, and were up 6.5% from last quarter. Additionally, they were up 26.3% compared to the same quarter in 2019.

Among total upcoming lots, roadwork was largely flat year-over-year, down 0.2%. Roadwork is comprised of the two smaller stages–streets paved and streets in–and represents the last step in lot development. Lots in the excavation stage were up 6.7% year-over-year, while those with equipment on site were also up 6.7%.

The largest share of total upcoming lots were in the excavation stage in 1Q25, making up 59% nationally. These lots have an expected delivery between 4Q25 and 1Q26 (the range represents different timeframes from local entitlement processes). Note, not all of the lots in excavation will match Zonda’s estimated timeline.

“There has been a lot of money invested in land and lot development in recent years, and we are seeing the fruit of that labor show up in total upcoming lots,” said Wolf. “The big question now is how aggressive builders will be in the shifting market with housing starts, new community openings, and their land acquisition plans.”