New Home Market Update

We spent much of 2019 holding our breath, not sure whether we should believe that the rebound in the economy from the second half of 2018 was real. Heading into the new year, 2020 started with some momentum thanks, in part, to three rate cuts from the Federal Reserve in 2019. The risks of an imminent recession are easing, driven by factors such as the phase one trade deal between the US and China signed earlier this week, the once inverted yield curve is back to being positively sloped (though not overly steep), and housing demand is showing resilience. These changes are bolstering equity markets and driving up confidence. As we learned with the conflict with Iran earlier this month, however, political and geopolitical risks are the hardest to predict and could turn the direction of the economy almost overnight.

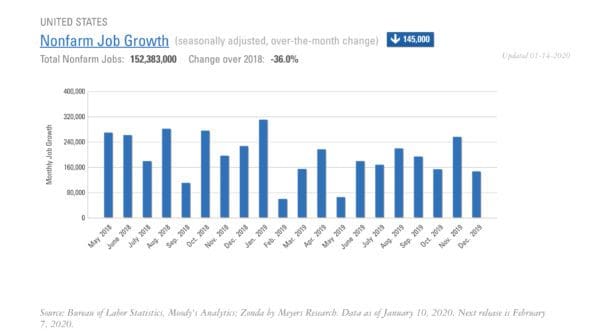

Nonfarm payrolls have increased for 111 consecutive months, the longest stretch on record.

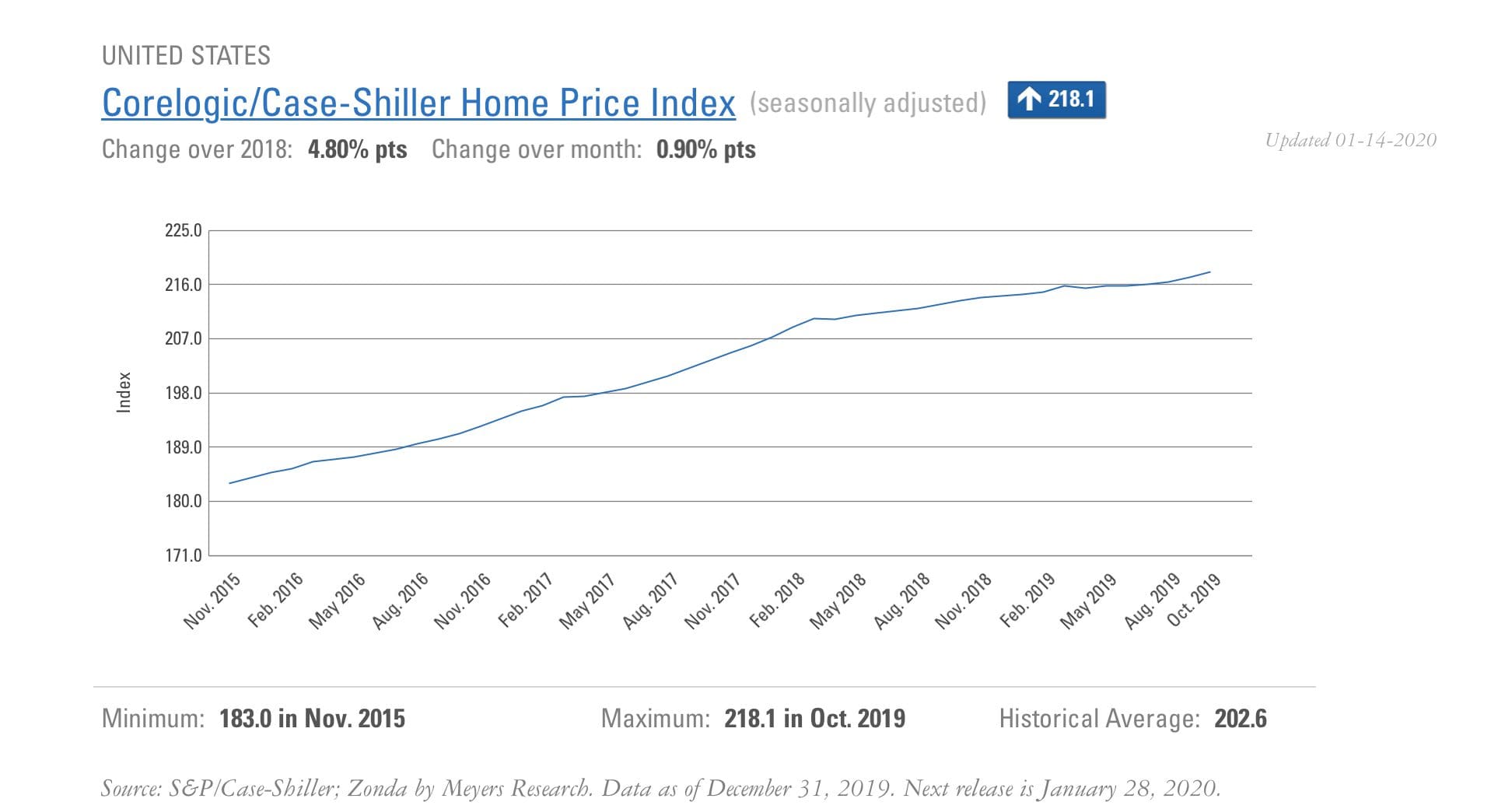

The Case-Shiller National Index increased 3.3% year-over-year.

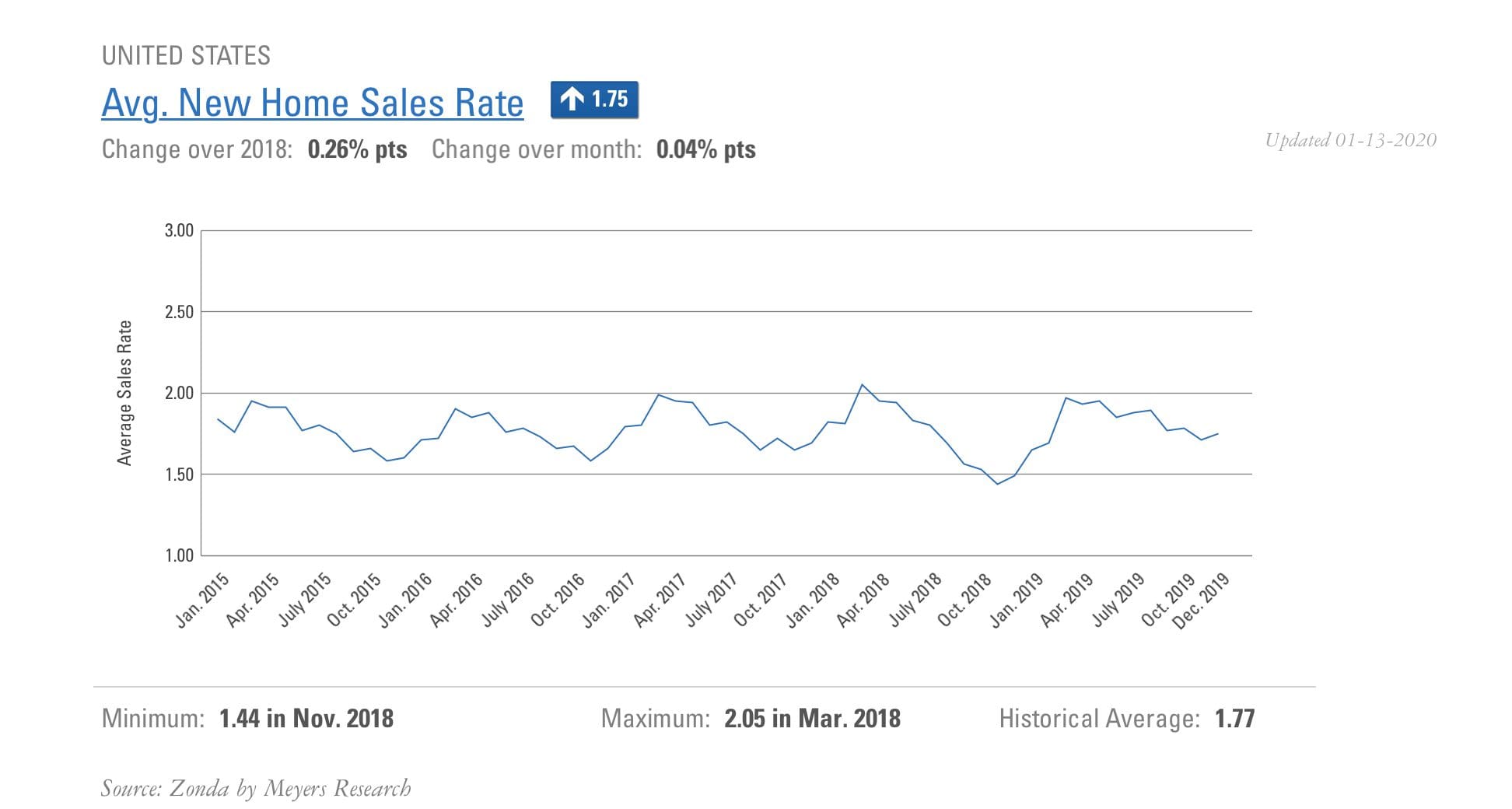

Given the easy comps for home sales in the second half of 2018, the two-year change is as important as the year-over-year figures. Both show strength in the housing market.