New Home Market Update

Builder 100 – Zonda’s 37th annual gathering of top U.S. builders – is wrapping up today. The event covers critical industry topics, including the sharp rise of single-family rental (SFR) and build-to-rent (BTR) as a permanent asset class.

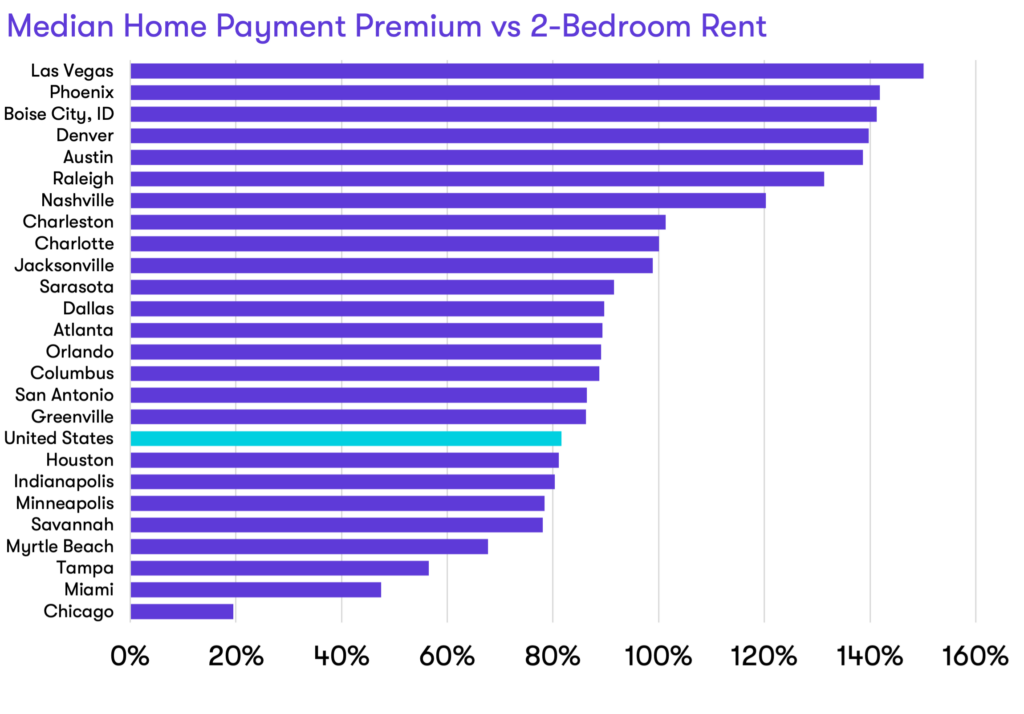

- Nationally, it is 82% more expensive to own a home than rent, based on monthly payments. Homeownership remains much more expensive than renting a 2-bedroom unit in top markets.

- Mortgage rates remain elevated despite coming down from 23-year highs, holding around 7%. Rates are expected to remain elevated for an extended period of time.

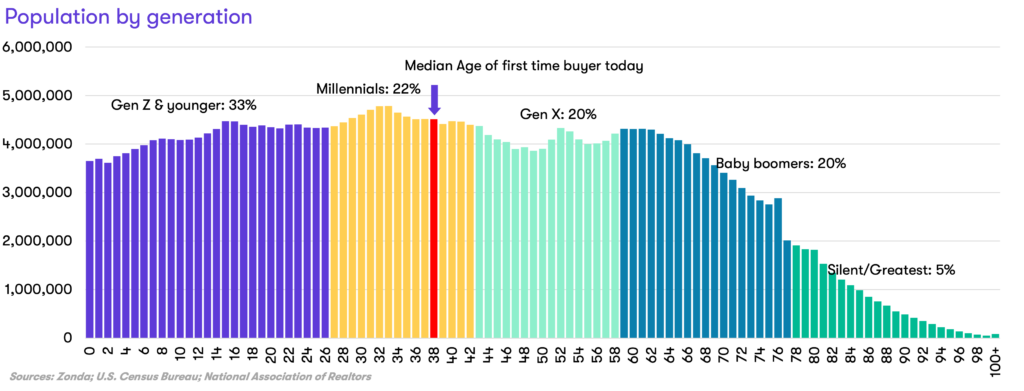

- As a result, Millennials are the largest generation of Americans that will likely be renting longer over the next several years.

- Currently, the median age for first-time buyers is 38 years old, with over half of Millennials younger than that and a wave of Gen Z that is already renting behind them.

- Combined with an aging population, renters span the age and lifestyle spectrum, from single professionals to growing families and downsizing empty nesters.

- Zonda is a unique housing data provider through its understanding that all consumers, throughout their lives, move through a renter/ownership spectrum.

Recognizing these realities, renters’ expectations are on the rise across the nation. Zonda rental expert Kimberly Byrum presented insights on how builders are addressing affordability for this growing group of influential, discerning renters, while also maximizing land use, in a session titled ‘Expanding Horizons: Multifamily and Build-to-Rent Diversification Success’.

Recognizing these realities, renters’ expectations are on the rise across the nation. Zonda rental expert Kimberly Byrum presented insights on how builders are addressing affordability for this growing group of influential, discerning renters, while also maximizing land use, in a session titled ‘Expanding Horizons: Multifamily and Build-to-Rent Diversification Success’.

“While we’re seeing one of the largest cohorts in our lifetimes within the rental market, there is no reason why these individuals should not still be able to choose new home construction to serve their personal lifestyle needs,” says Kimberly Byrum, Managing Principal – Multifamily at Zonda. “There is no ‘pause button’ on life stage events, and leading builders understand that — making it possible for more and more homeproud individuals to ‘test out’ communities and types of homes, before they are ready to buy.”

The nation’s largest Build-to-Rent builders were recently unveiled as part of the Builder 100 and Next 100 lists. These builders cater to Metro Lifestyle, Metro Avenues, Suburban Lifestyle, Suburban Avenues, Senior Metro, Senior Lifestyle, and Senior Avenues consumer segments. (See Methodology section for descriptions of these consumer segments.)

Expectations of ‘homeproud’ renters include: private outdoor spaces, clubhouse/fitness center, pool, playground/green spaces, dog park, and onsite leasing/maintenance.

- Nearly two-thirds of BTR product rents between $2,000 and $2,500 per month nationally.

- Las Vegas, Phoenix, and Boise have the highest homeownership premiums at roughly 140%+. While rents have risen dramatically in these markets, home prices combined with mortgage rates have pushed the cost of homeownership up even more.

- The homeownership premium is relatively low compared to renting in markets like Chicago and Miami (20%-40%+). We attribute this to higher 2-bedroom rents in the core submarkets pulling up the average rent and reducing the premium.

- BTR unit counts have grown sharply over the past year, climbing to nearly 170K as more projects are completed. The rate of growth has slowed modestly as the pool of completed units steadily increases. We expect this trend to continue to remain strongly positive through 2025, as under construction is steadily completed. There are roughly 117,000 BTR units under construction.

Learn more

Learn more about our Rental Housing Outlook with exclusive research, forecasts, and analysis.

Kimberly Byrum will be speaking next at IMN Single Rental Family East on May 19. You can also join her at Zonda’s Multifamily Executive Conference from Nov. 4-6 in Newport Beach, CA.