New home sales steady within seasonal ranges

New home sales rose modestly in November, largely driven by an increase in actively selling projects and the availability of standing inventory. However, after adjusting for supply, market activity remained flat for another month. Pricing trends were also nuanced: entry-level prices declined year-over-year, while the high-end market remained resilient, posting growth. The overall market, though, continued to rank as average according to our Zonda Market Ranking.

As we close out the year, market sentiment has shifted significantly over the past twelve months. Heading into 2025, post-election relief and optimism for a positive “surprise” defined the outlook, with builders actively ramping up starts ahead of the spring selling season. Today, that optimism has been replaced by growing caution around affordability, consumer confidence, and the labor market, along with a sharper focus on aligning starts with sales.

“All eyes are on the labor market as we head into 2026,” said Ali Wolf, chief economist for Zonda and NewHomeSource. “2025 was marked by volatility, including three months of national job losses and an increasing number of markets seeing year-over-year declines in high-income employment. A ‘blockbuster’ economy isn’t a prerequisite for a healthy housing market, but stability is essential.”

New home sales posted a modest increase

Zonda’s new home sales metric counts the number of new home contract sales each month and accounts for both cancellations and seasonality. This metric shows there were 719,581 new homes sold in November on a seasonally adjusted annualized rate. This was a gain of 0.9% from last month and an increase of 0.2% from a year ago. On a non-seasonally adjusted basis, 53,999 homes were sold, 1.3% higher than last year and 12.6% above the same month in 2019.

PSI: Down both MOM and YOY

Zonda’s New Home Pending Sales Index (PSI) was created to help account for fluctuations in supply by combining both total sales volume with the average sales rate per month per community. The November PSI came in at 136.6, representing a 1.4% decline from the same month last year. The index is currently 21.6% below cycle highs. On a month-over-month basis, seasonally adjusted new home sales decreased 1.8%.

- The markets that posted the best numbers relative to last year were San Antonio (+14.4%), Orlando (+14.1%), and Minneapolis (+6.9%). San Antonio was up compared to the last year and grew 4.4% month-over-month.

- Inversely, the metros that performed the worst year-over-year were Cincinnati (-22.8%), Las Vegas (-17.5%), and Denver (-16.9%).

- On a monthly basis, Salt Lake City, Baltimore, and Charlotte were the best performing markets. Salt Lake City increased 20.2% compared to last month.

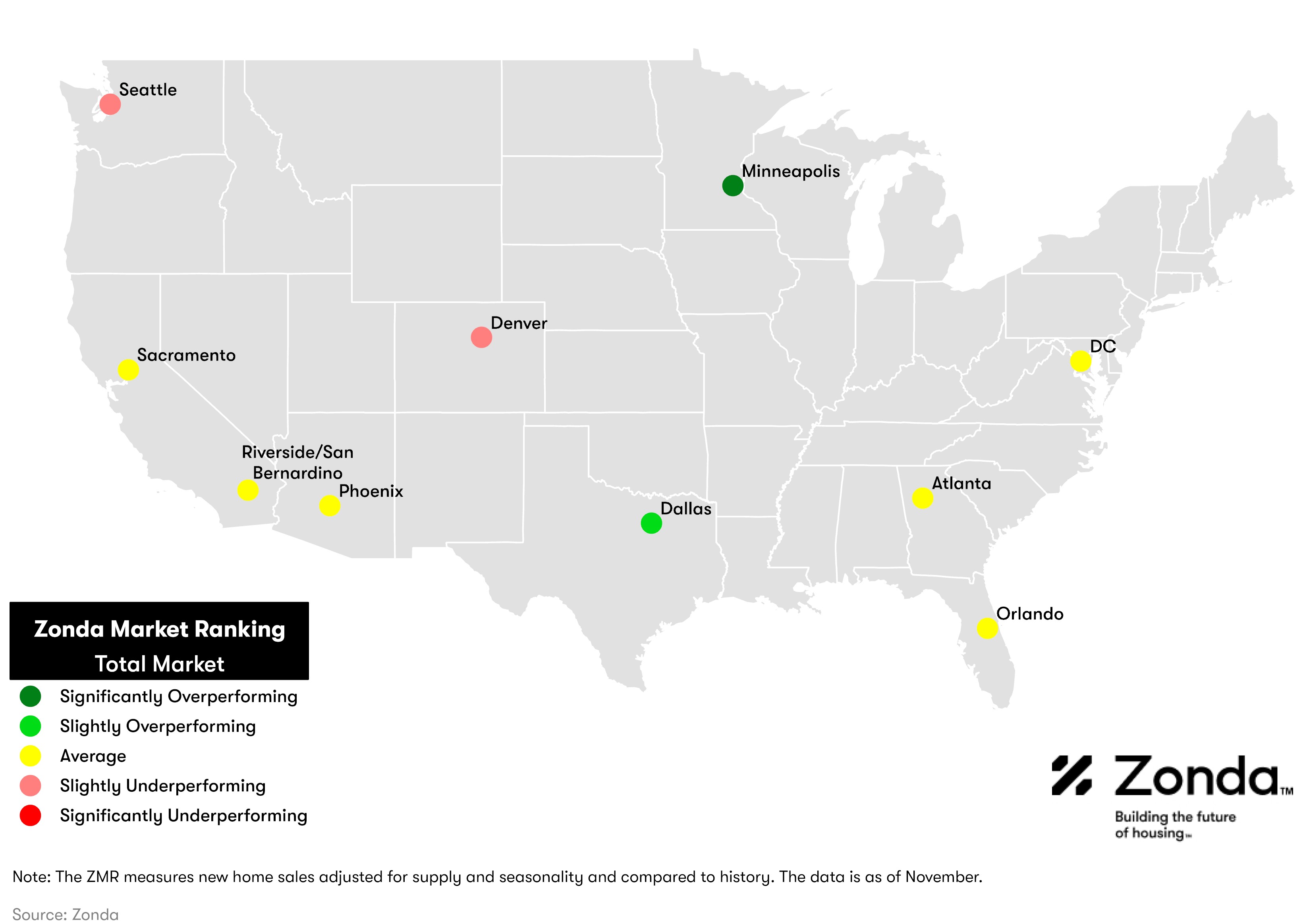

National ZMR held steady with an average rating in November

In order to add further context to sales, Zonda created the Zonda Market Ranking (ZMR). The ZMR accounts for both sales pace and volume, is seasonally adjusted, and is taken as a percentage relative to a baseline market average. Based on the percentage above or below baseline, markets are bucketed into performance groups ranging from significantly underperforming to significantly overperforming relative to historical activity.

The map below shows a snapshot of top production markets by region. Zonda also offers the ZMR for entry-level, move-up/move-down, and high-end markets. Subscribers of the National Outlook report can access all top markets and the tiered breakdown in Zonda’s portal. Non-subscribers can access the tiered maps for the select 10 markets by clicking below.

- The National ZMR index came in at 109.9 in November, which was flat month-over-month and continued to indicate an average market. The national ZMR has been average throughout 2025 so far after being rated slightly overperforming for all of 2024.

- Zonda’s snapshot markets were split between 20% overperforming, 60% average, and 20% underperforming, largely consistent with last month’s numbers. Among Zonda’s top 50 major markets, 36% were overperforming, 48% were average, and 16% were underperforming.

- Importantly, the ZMR does not account for what it takes to sell a home. For example, securing a sale might still feel difficult in a significantly overperforming market, but if the incentives offered result in a sale, we count the sale.

Entry-level prices fell, high-end rose

National home prices fell 1.0% for entry-level to $323,849, held flat for move-up at $517,079, and rose 3.1% for high-end homes to $931,921. The rise in high-end home prices reflects new communities opening at higher price points, improvements in design quality, larger lots and home sizes, and/or better locations.

Supplementing our data with a survey Zonda conducts monthly, 37% of builders lowered prices in November month-over-month, 61% held prices flat, and 2% raised prices. In October, for comparison, 26% of builders lowered prices, 71% held prices flat, and 4% increased prices.

Incentives are still common in today’s housing market to help address the affordability constraints for buyers. In November, 60% of new home communities offered incentives on to-be-built homes and 78% on quick move-in supply. Note, these are only publicly advertised incentives so will underrepresent overall usage.

Community counts rose 2% YOY

There are currently 17,086 actively selling communities tracked by Zonda, up 2.0% from last year. On a month-over-month basis, the national figure was largely flat (+0.6%). The national community count remains below the same month in 2019. Zonda defines a community as anywhere where five or more units are for sale.

- Charlotte (+12.0%), San Francisco (+8.6%), and Orlando (+5.8%) grew community count the most year-over-year.

- Relative to last year, the biggest community count declines were in Philadelphia (-15.6%), New York (-13.0%), and Minneapolis (-11.9%).

National quick move-ins (QMIs) totaled 34,889, up 5.7% compared to last year but 10.6% lower month-over-month. Total QMIs are 58.1% above 2019 levels. QMIs are homes that can likely be occupied within 90 days.

For many consumers, QMIs provide a great alternative to resale supply given they are brand new and (often) come with builder incentives. These homes aren’t flying off the shelf as they once did, though, so builders are still working through their backlog of inventory but are more cautious with new starts.

- On a metro basis, 68% of Zonda’s select markets increased QMI count year-over-year.

- The markets that grew the most year-over-year were Washington, DC (+79.6%), San Francisco (+71.1%), and Seattle (+71.1%).

- Salt Lake City, Las Vegas, and Cincinnati have seen the most growth in QMIs compared to the same time in 2019, up 280.4%, 212.4%, and 208.8% respectively.

QMIs per community is a good way to track how new home supply looks in the context of actively selling projects. There were 2.3 QMIs per community nationally in November, up 14.9% from the 2.0 recorded this time last year but have trended down for two consecutive months.

Please note, the QMI per community data aligns with this report covering November trends. Our quick move-in data is weekly, and we release the latest available at the time of publishing this report. As such, recreating the visual below with the data above will yield slightly different results.

Are you interested in seeing past National Housing Market Update and Pending Sales Index reports? Access our report library to learn more.

Methodology

The Zonda New Home Pending Sales Index (PSI) is built on proprietary, industry-leading data that covers 85% of the production new home market across the United States. Reported number of new home pending contracts are gathered and analyzed each month. Released on the 15th business day of each month, the New Home PSI is a leading indicator of housing demand compared to closings because it is based on the number of signed contracts at a new home community. Zonda monitors 17,000 active communities in the country and the homes tracked can be in any stage of construction.

The new home market represents roughly 10% of all transactions, allowing little movements in supply to cause outsized swings in market activity. As a result, the New Home PSI blends the cumulative sales of activity recently sold-out projects with the average sales rate per community, which adjusts for fluctuations in supply. Furthermore, the New Home PSI is seasonally adjusted based on each market’s specific seasonality, removes outliers, and uses June 2016 as the base month. The foundation of the index is a monthly survey conducted by Zonda. It is necessary to monitor both new and existing home sales to establish an accurate picture of the relative health of the residential real estate market.

About Zonda

Zonda provides data-driven housing market solutions to the homebuilding industry. From builders to building product manufacturers, mortgage clients, and multifamily executives, we work hand-in-hand with our customers to streamline access to housing data to empower smarter decisions. As a leading brand in residential construction, our mission is to advance the home building industry, because we believe better homes mean better lives and stronger communities. Together, we are building the future of housing.