New home sales are in a holding pattern

The central question facing many prospective homebuyers today is one of timing and confidence: Is now the right time to buy? For many, the answer appears to be “maybe not.” New home sales were largely flat month-over-month and year-over-year in October, reflecting a market where consumers want, or even need, to buy, but are waiting to see how conditions evolve.

This leads to an equally important question for the housing industry: What conditions will give consumers enough confidence to jump back into the market? The answer comes down to some degree of stability across three categories: the job market, mortgage rates, and prices, along with a meaningful improvement in housing affordability.

“The holding pattern we are seeing today from prospective buyers is tied to economic anxieties and the job market,” said Ali Wolf, chief economist for Zonda and NewHomeSource. “While this makes for a tricky backdrop today, demographics and deferrals provide a nice setup to a stronger market once macro factors stabilize and consumer confidence returns.”

New home sales were flat in October

Zonda’s new home sales metric counts the number of new home contract sales each month and accounts for both cancellations and seasonality. This metric shows there were 713,769 new homes sold in October on a seasonally adjusted annualized rate. This was largely flat month-over-month and year-over-year. On a non-seasonally adjusted basis, 57,513 homes were sold, 1.8% higher than last year and 10.1% above the same month in 2019.

PSI: Up MOM, down YOY

Zonda’s New Home Pending Sales Index (PSI) was created to help account for fluctuations in supply by combining both total sales volume with the average sales rate per month per community. The October PSI came in at 141.9, representing a 3.5% decline from the same month last year. The index is currently 18.5% below cycle highs. On a month-over-month basis, seasonally adjusted new home sales increased 0.8%

- The markets that posted the best numbers relative to last year were San Francisco (+29.5%), Dallas (+4.2%), and Phoenix (+3.4%). San Francisco was up compared to the last year and grew 11.2% month-over-month.

- Inversely, the metros that performed the worst year-over-year were New York (-21.3%), Tampa (-18.4%), and Las Vegas (-17.7%).

- On a monthly basis, Baltimore, New York, and San Francisco were the best performing markets. Baltimore increased 26.7% compared to last month.

National ZMR remained average in October, continuing its 2025 trend

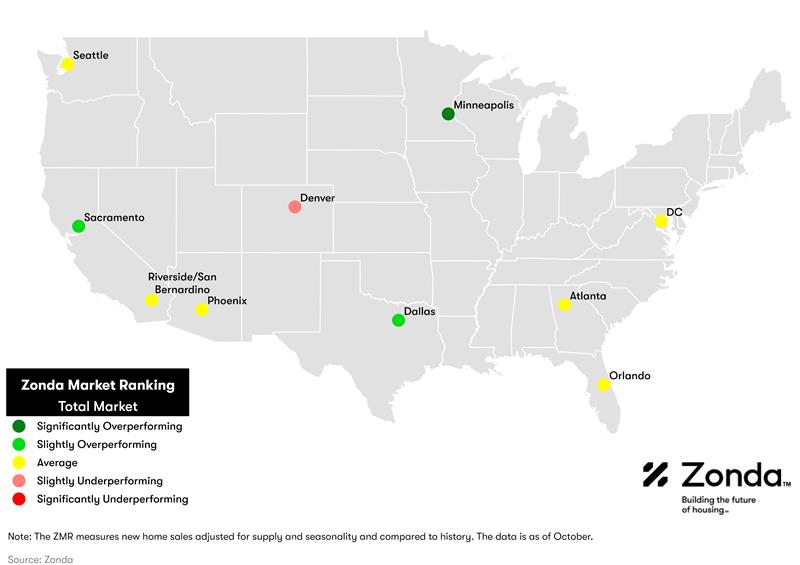

In order to add further context to sales, Zonda created the Zonda Market Ranking (ZMR). The ZMR accounts for both sales pace and volume, is seasonally adjusted, and is taken as a percentage relative to a baseline market average. Based on the percentage above or below baseline, markets are bucketed into performance groups ranging from significantly underperforming to significantly overperforming relative to historical activity.

The map below shows a snapshot of top production markets by region. Zonda also offers the ZMR for entry-level, move-up/move-down, and high-end markets. Subscribers of the National Outlook report can access all top markets and the tiered breakdown in Zonda’s portal. Non-subscribers can access the tiered maps for the select 10 markets by clicking below.

- The National ZMR index came in at 110.1 in October, which was flat month-over-month and continues to indicate an average market. The National ZMR has been average throughout 2025 so far after being rated slightly overperforming for all of 2024.

- Zonda’s snapshot markets were split between 30% overperforming, 60% average, and 10% underperforming, largely consistent with last month’s numbers. Among Zonda’s top 50 major markets, 38% were overperforming, 40% were average, and 22% were underperforming.

- Importantly, the ZMR does not account for what it takes to sell a home. For example, securing a sale might still feel difficult in a significantly overperforming market, but if the incentives offered result in a sale, we count the sale.

Entry-level prices fell

National home prices increased year-over-year for move-up and high-end homes. Prices fell 1.0% for entry-level to $324,583 but rose 0.3% for move-up to $518,406 and 2.2% for high-end homes to $932,501. The rise in high-end home prices reflects new communities opening at higher price points, improvements in design quality, larger lots and home sizes, and/or better locations.

Supplementing our data with a survey Zonda conducts monthly, 26% of builders lowered prices in October month-over-month, 71% held prices flat, and 4% raised prices. In September, for comparison, 30% of builders lowered prices, 65% held prices flat, and 5% increased prices.

Incentives are still common in today’s housing market to help address the affordability constraints for buyers. In October, 60% of new home communities offered incentives on to-be-built homes and 79% on quick move-in supply. Note, these are only publicly advertised incentives so will underrepresent overall usage.

Community counts have had steady growth in 2025

There are currently 17,147 actively selling communities tracked by Zonda, up 2.5% from last year. On a month-over-month basis, the national figure grew 0.8%. The national community count is up both MOM and YOY, but remains 11.4% below the same month in 2019. Zonda defines a community as anywhere where five or more units are for sale.

- San Francisco (+12.2%), Charlotte (+11.0%), and Orlando (+8.1%) grew community count the most year-over-year.

- Relative to last year, the biggest community count declines were in Philadelphia (-14.3%), Washington, DC (-11.3%), and New York (-10.9%).

National quick move-ins (QMIs) totaled 36,287, up 8.5% compared to last year but 12.5% lower month-over-month. Total QMIs are 65.5% above 2019 levels. QMIs are homes that can likely be occupied within 90 days.

For many consumers, QMIs provide a great alternative to resale supply given they are brand new and (often) come with builder incentives. These homes aren’t flying off the shelf as they once did, though, so builders are still working through their backlog of inventory but are more cautious with new starts.

- On a metro basis, 76% of Zonda’s select markets increased QMI count year-over-year.

- The markets that grew the most year-over-year were Seattle (+100.4%), Washington, DC (+88.5%), and Baltimore (+78.9%).

- Salt Lake City, Las Vegas, and Cincinnati have seen the most growth in QMIs compared to the same time in 2019, up 328.6%, 227.7%, and 198.0%, respectively.

QMIs per community is a good way to track how new home supply looks in the context of actively selling projects. There were 2.5 QMIs per community nationally in October, up 25% from the 2.0 recorded this time last year.

Please note, the QMI per community data aligns with this report covering October trends. Our quick move-in data is weekly, and we release the latest available at the time of publishing this report. As such, recreating the visual below with the data above will yield slightly different results.

Are you interested in seeing past National Housing Market Update and Pending Sales Index reports? Access our report library to learn more.

Methodology

The Zonda New Home Pending Sales Index (PSI) is built on proprietary, industry-leading data that covers 85% of the production new home market across the United States. Reported number of new home pending contracts are gathered and analyzed each month. Released on the 15th business day of each month, the New Home PSI is a leading indicator of housing demand compared to closings because it is based on the number of signed contracts at a new home community. Zonda monitors 17,000 active communities in the country and the homes tracked can be in any stage of construction.

The new home market represents roughly 10% of all transactions, allowing little movements in supply to cause outsized swings in market activity. As a result, the New Home PSI blends the cumulative sales of activity recently sold-out projects with the average sales rate per community, which adjusts for fluctuations in supply. Furthermore, the New Home PSI is seasonally adjusted based on each market’s specific seasonality, removes outliers, and uses June 2016 as the base month. The foundation of the index is a monthly survey conducted by Zonda. It is necessary to monitor both new and existing home sales to establish an accurate picture of the relative health of the residential real estate market.

About Zonda

Zonda provides data-driven housing market solutions to the homebuilding industry. From builders to building product manufacturers, mortgage clients, and multifamily executives, we work hand-in-hand with our customers to streamline access to housing data to empower smarter decisions. As a leading brand in residential construction, our mission is to advance the home building industry, because we believe better homes mean better lives and stronger communities. Together, we are building the future of housing.

Subscribe for updates

Stay in the know with Zonda updates direct to your inbox. Subscribe today to receive webinar information, economics reports, podcast episodes, and more!