Zonda’s New Home Lot Supply Index (LSI) for 3Q25, showed lot supply loosened both year-over-year and quarter-over-quarter across the United States, notching the fifth consecutive increase from previous quarters. The index is a residential real estate indicator based on the number of single-family vacant developed lots (VDL) and the rate at which those lots are absorbed via housing starts.

- The New Home LSI came in at 73.2 for 3Q25, representing a 27.0% increase from 3Q24. The 3Q25 data shows a significantly undersupplied market nationally but is edging close to slightly undersupplied. The market has been significantly undersupplied since 2017.

- On a quarter-over-quarter basis, supply increased by 7.1% from 2Q25.

- The LSI counts the total vacant developed lot supply and adjusts it for overall starts activity.

“For the first time in eight years, Zonda’s LSI is on the verge of moving from significantly undersupplied to slightly undersupplied,” said Ali Wolf, chief economist for Zonda and NewHomeSource. “The shift in our LSI is more a function of demand than supply, though. Builders are intentionally reducing housing starts to align with sluggish demand, which is slowing lot absorption.”

Lot supply loosened year-over-year in most major metropolitan areas in 3Q25, with 24 of 30 increasing, a number that has increased each of the last 4 quarters.

- Despite the loosening trend, lot inventory was still categorized as significantly undersupplied in most markets in 3Q25.

- The markets where land supply loosened the most on a year-over-year basis were led by San Francisco, Tampa, and LA/OC. Related, 3Q starts were down in each of these markets compared to this time last year.

- Baltimore tightened the most year-over-year, falling 39.0% to 18.7, which makes it the second tightest lot market in the country. San Diego continued to rank as the tightest, with Miami just behind Baltimore.

- Austin, Atlanta, and Dallas were again the top 3 markets for loosest lot supply in 3Q, with Austin moving up to a slightly oversupplied market. Atlanta and Dallas continued to be rated as appropriately supplied. Denver and San Francisco are also appropriately supplied, with all other markets being undersupplied.

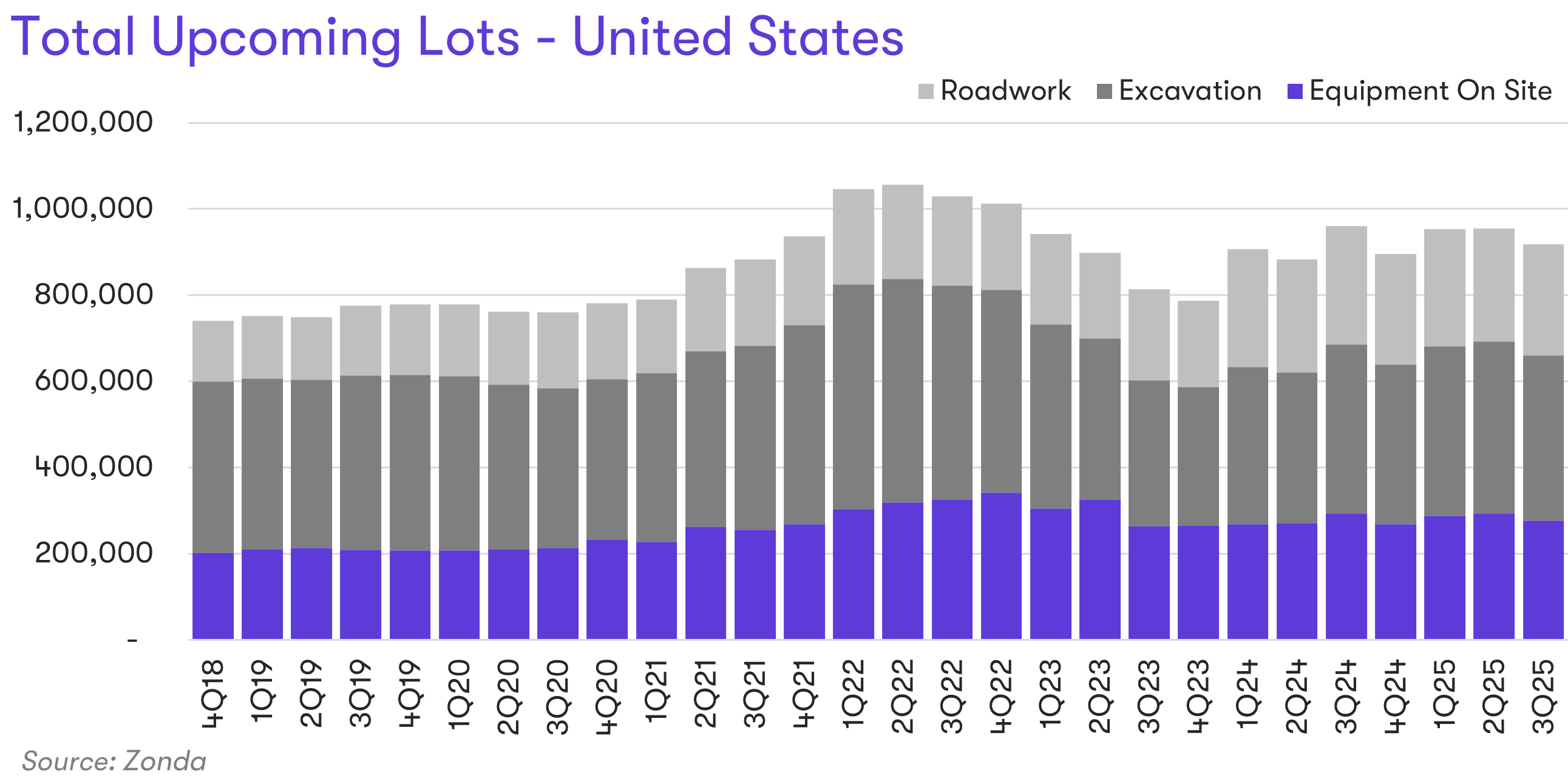

Zonda also records future lots through the stages of development. The stages range from raw land through streets in, which is the last step before the lot becomes a vacant developed lot. Zonda groups the last few stages into a classification called total upcoming lots, which typically indicates delivery over the next 12-18 months.

Total upcoming lots in 3Q25 decreased 4.4% year-over-year and 3.9% quarter-over-quarter. These types of lots were down 13% from the 2022 peak but were up 18.3% compared to the same quarter in 2019.

Among total upcoming lots, roadwork was down 6.1% year-over-year. Roadwork is comprised of the two smaller stages–streets paved and streets in–and represents the last step in lot development. Lots in the excavation stage were down 2.1% year-over-year, while those with equipment on site were also down 5.8%.

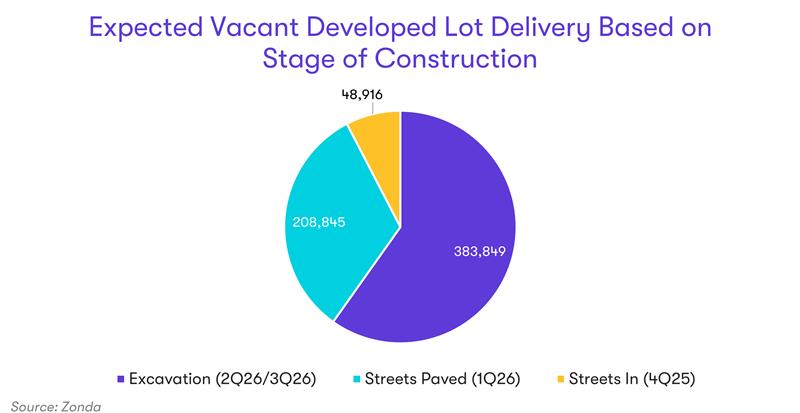

The largest share of total upcoming lots were in the excavation stage in 3Q25, totaling nearly 385K. These lots have an expected delivery between 2Q26 and 3Q26 (the range represents different timeframes from local entitlement processes). Note, not all of the lots in excavation will match Zonda’s estimated timeline.

“The downtick in total upcoming lots is logical: builders are starting fewer homes, slowing takedowns, and renegotiating existing land deals. Together, these factors reduce lot requirements,” said Wolf. “While Zonda forecasts flat housing starts in 2026 relative to 2025, we are closely watching key indicators—namely interest rates, demand, home prices, and the labor market—that could signal a more significant market change.”

Read past reports

Are you interested in reading past New Home Lot Supply Index reports? Access our report library to learn more.

Go deeper with Zonda Advisory services

Get more granular custom housing market data based on your region and your business needs. Learn more about our Advisory services to see how we can help you level up and meet your goals.

Methodology

The Zonda New Home Lot Supply Index (LSI) is built on proprietary, industry-leading data that covers the production new home market across the United States. The index values represent single-family vacant developed lot supply, lots that are ready to be built on, relative to equilibrium. Released quarterly, the New Home LSI provides an unrivaled look into the lot markets across the country, offering a current quarter snapshot as well as insight into the directional trend.

The New Home LSI is calculated based on each markets’ specific equilibrium as determined by our team of local experts and historical activity. The comparative current value is adjusted to capture the “true” months of supply figure by applying a greater weight to vacant developed lots in subdivisions with more starts activity. Each index value is associated with a phrase highlighting the current lot supply dynamics. A value of 100, represents perfect equilibrium, while a value of 125 and above equals “Significantly Oversupplied”, 115-125 – “Slightly Oversupplied”, 85-115 – “Appropriately Supply”, 75-85 – “Slightly Undersupplied”, and 75 and below – “Significantly Undersupplied.”

The foundation of the index is a quarterly release conducted by Zonda. It is necessary to monitor residential lot supply to understand how new home markets may be impacted by the incoming pipeline.