New Home Lot Supply Index

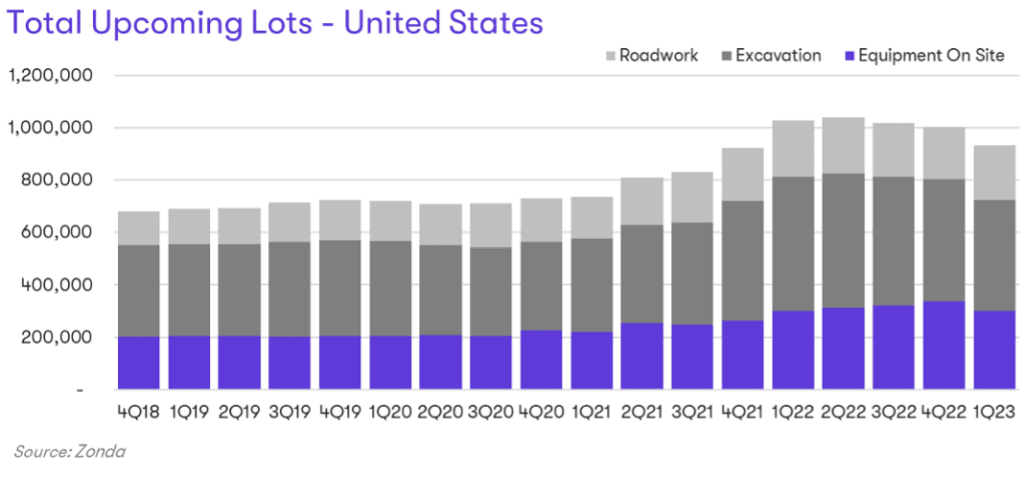

Zonda also records future lots through the stages of development. The stages range from raw land through streets in, which is the last step before the lot becomes a vacant developed lot. Zonda groups the last few stages into a classification called total upcoming lots, which typically indicates delivery over the next 12-18 months.

Total upcoming lots for 1Q23 decreased 9% year-over-year and fell 7% from last quarter. The largest declines among the total upcoming lots came in the streets-in stage, which fell 36% from the same period last year. The pullback in total upcoming lots in the first quarter corresponds with the market demand pullback in the third and fourth quarters of 2022 and the resulting uncertainty.

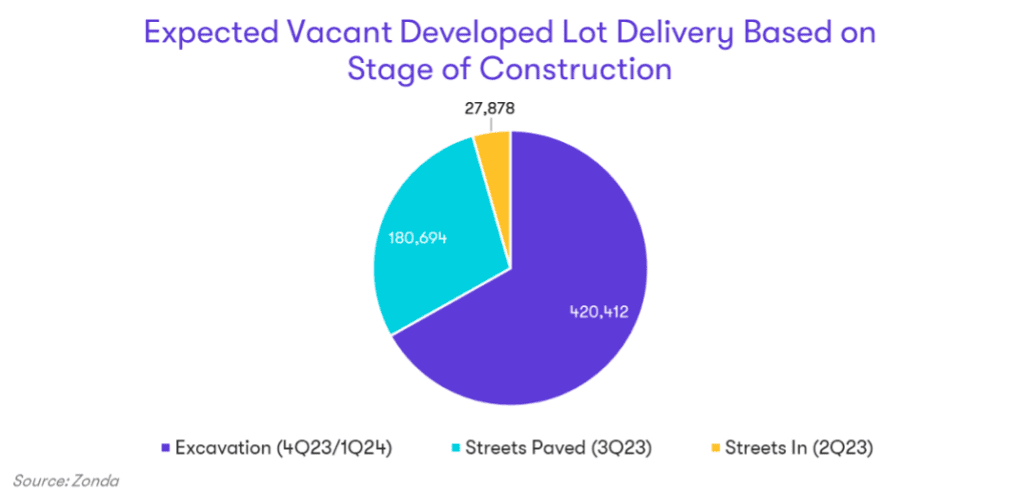

The largest share of total upcoming lots are in the excavation stage, making up 67% nationally. These lots have an expected delivery between 4Q23 and 1Q24 (the range represents different timeframes from local entitlement processes). Note, not all of the lots in excavation will match Zonda’s estimated timeline.