New Home Market Update

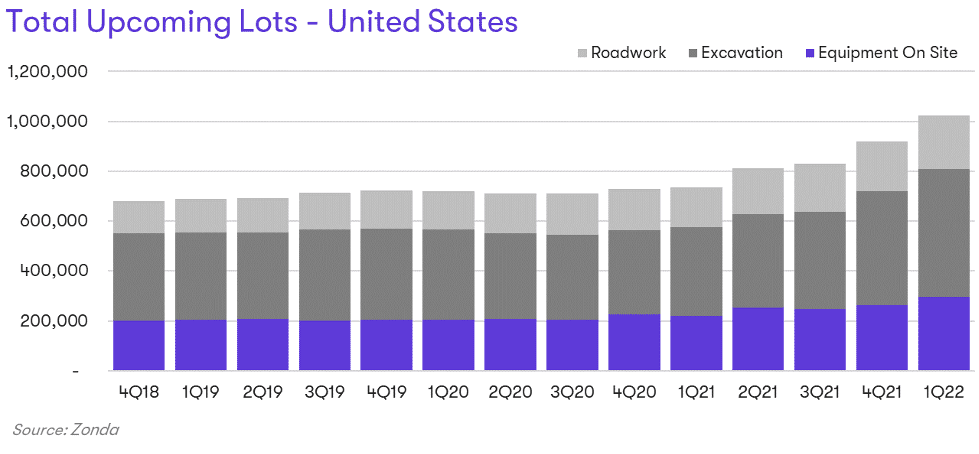

Zonda tracks future lots through the stages of development. The stages range from raw land through streets in, which is the last step before the lot becomes a VDL. Zonda groups the last few stages into a classification called total upcoming lots, which implies delivery within the next 12 months.

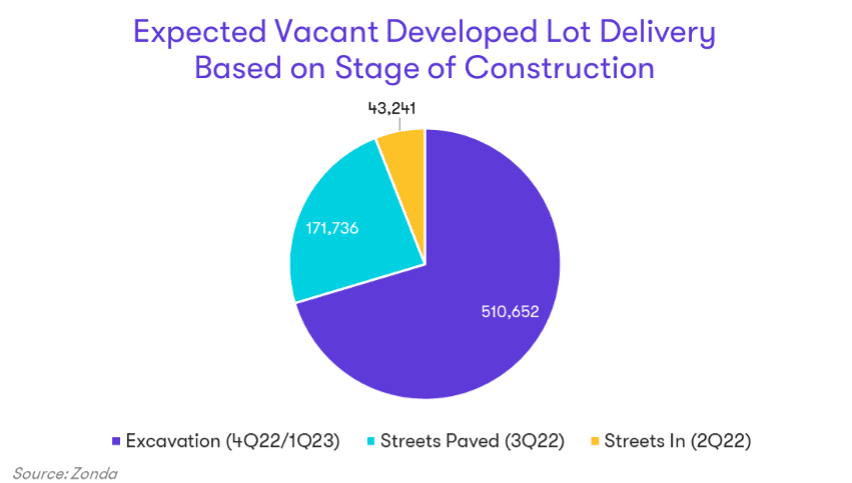

Total upcoming lots for 1Q22 increased 39% year-over-year and 11% from last quarter alone. The largest annual gains among the total upcoming lots came in the equipment on-site stage, which grew 40% from the same time last year and implies expected delivery in the following quarter. The current majority of total upcoming lots fall in the excavation stage, making up 70% nationally and have an expected delivery between 4Q22 and 1Q23 (the range represents different timeframes from local entitlement processes). Note, not all the lots in excavation will match Zonda’s estimated timeline.