Threw the Game: How Self-Tour Vendors Sabotage Your Sales

Stay informed about the latest trends in the rental housing industry by subscribing to Zonda’s Rental Housing Outlook or attending our upcoming Build-to-Rent Conference.

The Build-to-Rent (BTR) sector continues to evolve as it expands from the early years of institutional investment following the Great Financial Crisis.

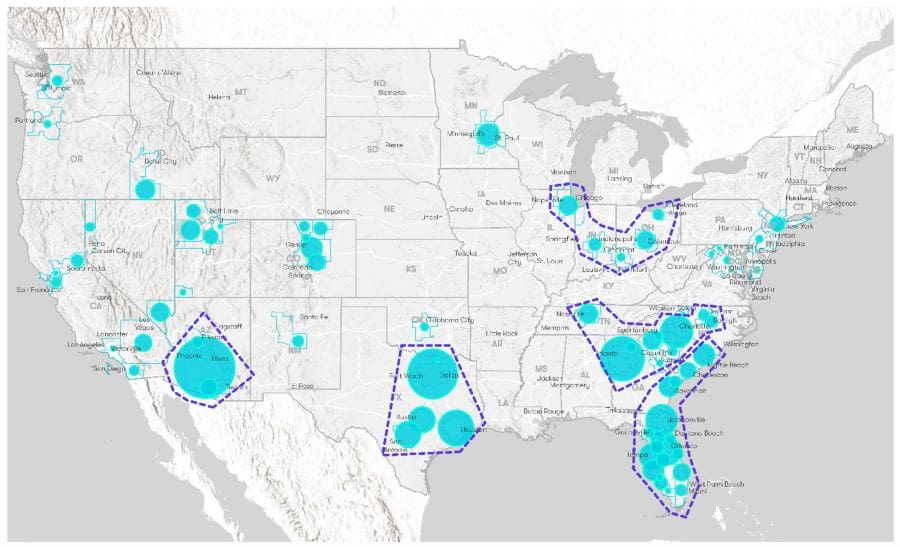

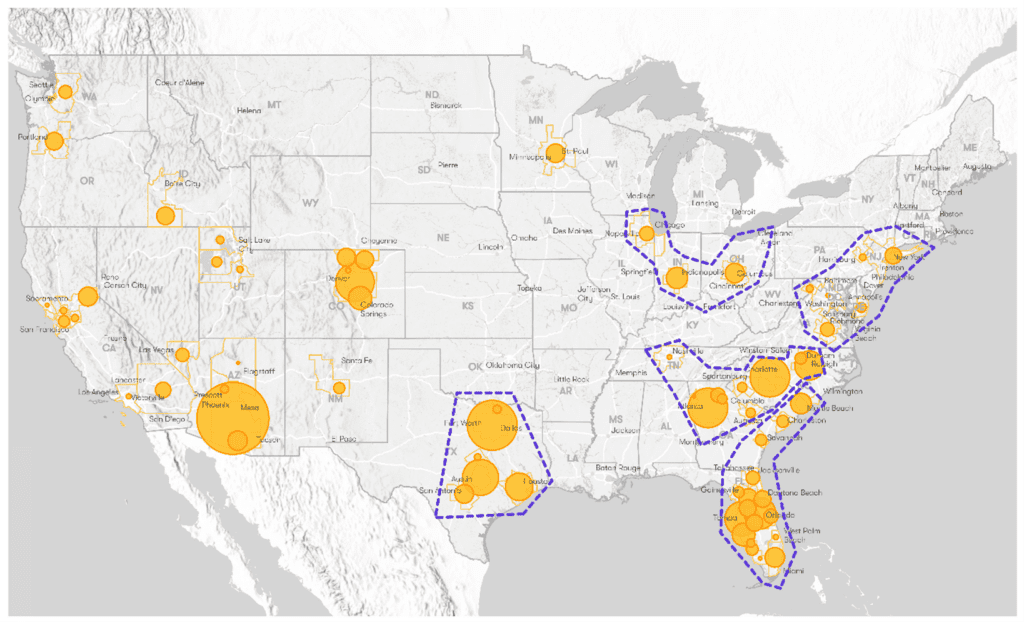

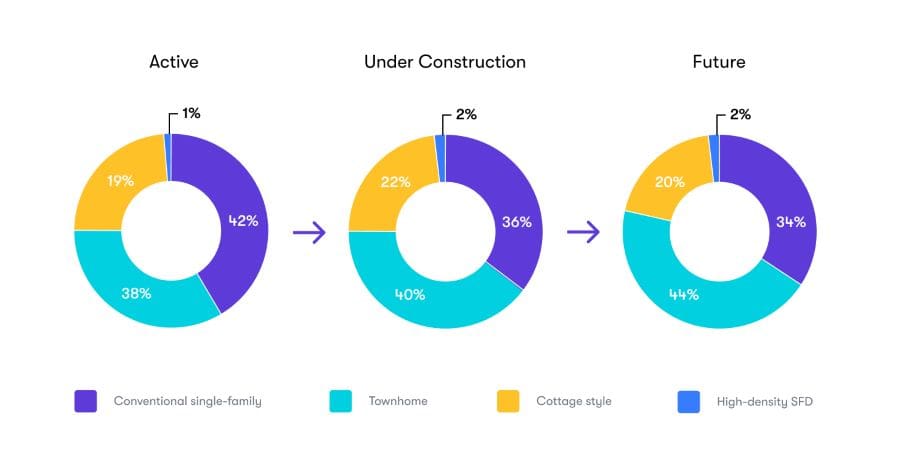

At that time, the BTR market consisted of predominantly single-family detached communities in further out locations of Sunbelt markets. Since then, investors and developers have not only shifted their focus from the Southwest, Texas, and the Southeast to other parts of the country, but they have started offering a wider array of product in various submarkets to capture more diverse segments of renter households.

Based on Zonda’s proprietary Census dataset of nearly all planned, under-construction, and active BTR communities, we can analyze the trends in both regional expansion and the shift from lower to higher-density product throughout the country. Zonda’s recently released Rental Housing Outlook provides unique insights into BTR based on this only-of-its-kind dataset.

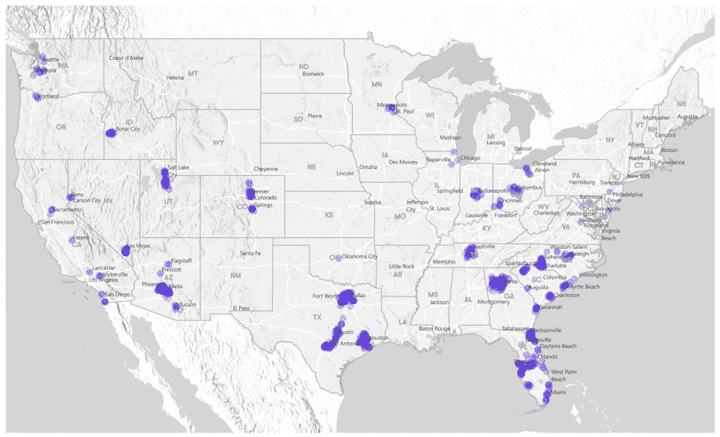

As noted, the early phases of BTR communities were focused primarily in the Sunbelt markets, due to the strong demand for housing based on steady population and household growth. The increase in demand was helped by an ample supply of developable land in these regions, particularly in further out locations, combined with increasing affordability challenges in the for-sale market.

The map below shows the concentration of active BTR communities in the top Sunbelt markets of Phoenix, Dallas, Atlanta, Houston, and Charlotte. These markets have close to or well over 10,000 active BTR units, with pipelines of thousands more under construction or planned.